Submission to inquiry into Treasury Laws Amendment (Your Future, Your Super) Bill 2021 [Provisions]

Private capital fund managers invest billions of dollars into Australian

companies every year. The private capital investment asset class has

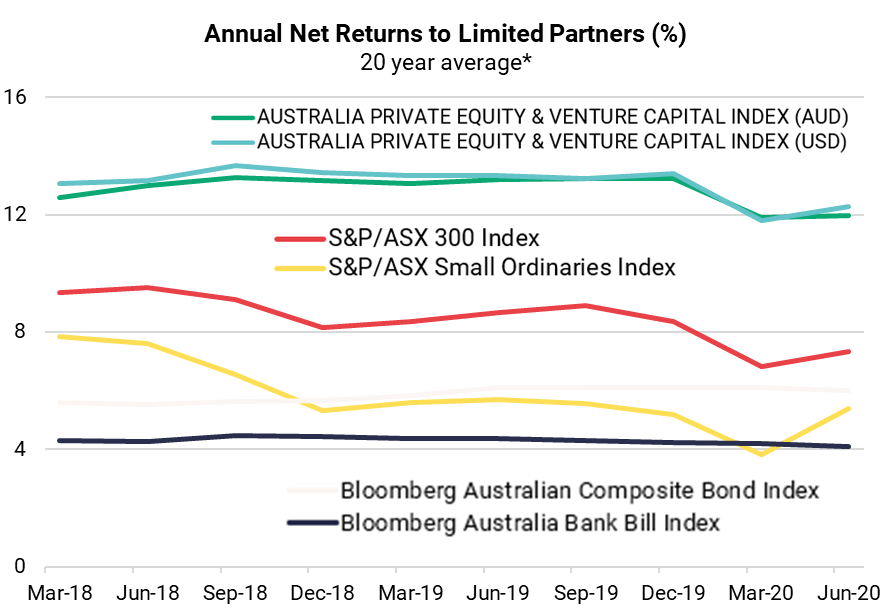

delivered investors an average net return after fees of 12.5 and 12 per

cent per annum, over the past 10 and 20 years, respectively.1 This strong

performance has provided Australian superannuation funds with superior

returns and valuable diversification. In response, Australian

superannuation funds have increased their investment into and alongside

private capital funds.

* 15-year average for March and June 2018

Source: Cambridge Associates Benchmark Data

The private capital industry is supportive of adopting the current proposal

which would see unlisted private capital investments benchmarked against

listed equities. It is important to acknowledge, however, that given the

uncertainties which surround how investment decision making will be

impacted over the short and medium-term by the introduction of these

reforms, it would be prudent for the government to ensure the implications

are monitored in real time; this includes the allocation of funds.

The Council urges the Committee to consider the merits of assessing

performance on a net of ‘total fees’ basis, in line with APRA’s heatmap

approach.

Some of the detail of the reforms will be contained in the forthcoming

regulations. It is vitally important that the regulations are drafted to

achieve the Government’s intent without imposing unnecessary costs or

generating unintended consequences. For example, the portfolio holding

disclosure exemption has protected member value by not requiring

superannuation funds to make public commercially sensitive information,

where doing so would be detrimental to the interests of members. In this

instance, how the regulations balance the need for transparency with the

need to protect member value will be important.

Click here to view the submission.

1 Cambridge Associates, Australia Private Equity & Venture Capital Index and Selected Benchmark Statistics (Q2 2020)